Economic Review April 2025

| The UK economy grew 0.5% in February, driven by strong service and manufacturing sectors despite looming headwinds | Inflation dipped to 2.6% in March, but April’s household bill hikes are expected to reverse the trend | The labour market weakened as vacancies fell, though wage growth remained robust amid cost pressures and job cuts |

UK economy returns to growth

Data released last month by the Office for National Statistics (ONS) showed economic growth was stronger than expected in February, although more recent survey evidence suggests this pick-up may prove short-lived as economic headwinds threaten growth prospects.

According to the latest gross domestic product (GDP) statistics, economic output rose by 0.5% in February, the fastest rate of expansion in 11 months. This figure was higher than all forecasts submitted to a Reuters poll of economists, which had pointed to a monthly rise of just 0.1%.

ONS said this stronger-than-expected performance partly reflected robust service sector growth, with computer programming, telecoms and car dealerships all performing well during February. In addition, ONS noted that manufacturing, electronics and pharmaceutical businesses all enjoyed a strong month.

Separately released trade figures for February also showed goods exports to the US hit their highest monthly level since November 2022. Analysts suggested the jump was a clear sign of firms trying to beat the imposition of President Trump’s tariffs.

Survey data, however, shows that those tariffs are now having a detrimental impact on business activity. Last month’s preliminary headline growth indicator from the closely monitored S&P Global/CIPS UK Purchasing Managers’ Index (PMI), for instance, fell to a 29-month low of 48.2 in April, down from 51.5 in March. This left the index significantly below the 50.0 threshold, denoting a contraction in private sector output.

S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “The disappointing survey reflects the impact of headwinds from both home and abroad. The biggest concern lies in a slump in exports amid weakened global demand and rising global trade worries, but higher staffing costs have also piled pressure on companies – linked to the National Insurance and minimum wage changes that came into effect at the start of April.”

Inflation rate eases before expected jump

Although last month’s inflation data showed the headline rate at its lowest level for three months, this dip is only expected to prove temporary with an acceleration in price growth likely to resume when April’s data is published later this month.

The latest ONS statistics revealed the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – fell to 2.6% in March from 2.8% the previous month. This reading was just below analysts’ expectations, with a Reuters poll pointing to a rate of 2.7%.

ONS noted that March’s decline was largely driven by falling petrol prices and a drop in prices for computer games. The one significant offsetting factor came from the clothing sector, with the price of clothes rising strongly following February’s surprise, unseasonal fall.

Despite this second monthly CPI decline, economists still expect to see a pick-up in inflationary pressures when April’s data is released on 21 May. This predicted jump will largely be driven by a host of household bill increases, which came into effect at the start of last month, as well as price pressures on businesses as they respond to the National Insurance and minimum wage hikes.

Forecasting the future path of inflation, however, has become more complicated with the introduction of Trump’s tariffs. Bank of England (BoE) policymaker Megan Greene recently suggested the tariffs would probably lead to lower rather than higher inflation in the UK, although she did stress big uncertainties still surround the tariff plan, adding “none of us have any idea what they’ll look like when the dust finally settles.”

While such uncertainties undoubtedly create a policy dilemma for the BoE, its interest-rate setting committee is widely expected to sanction another quarter-point rate cut this month, with its decision due to be announced on 8 May.

Markets

As April drew to a close, global markets were digesting fresh data from the States which showed that the economy contracted for the first time in three years during Q1.

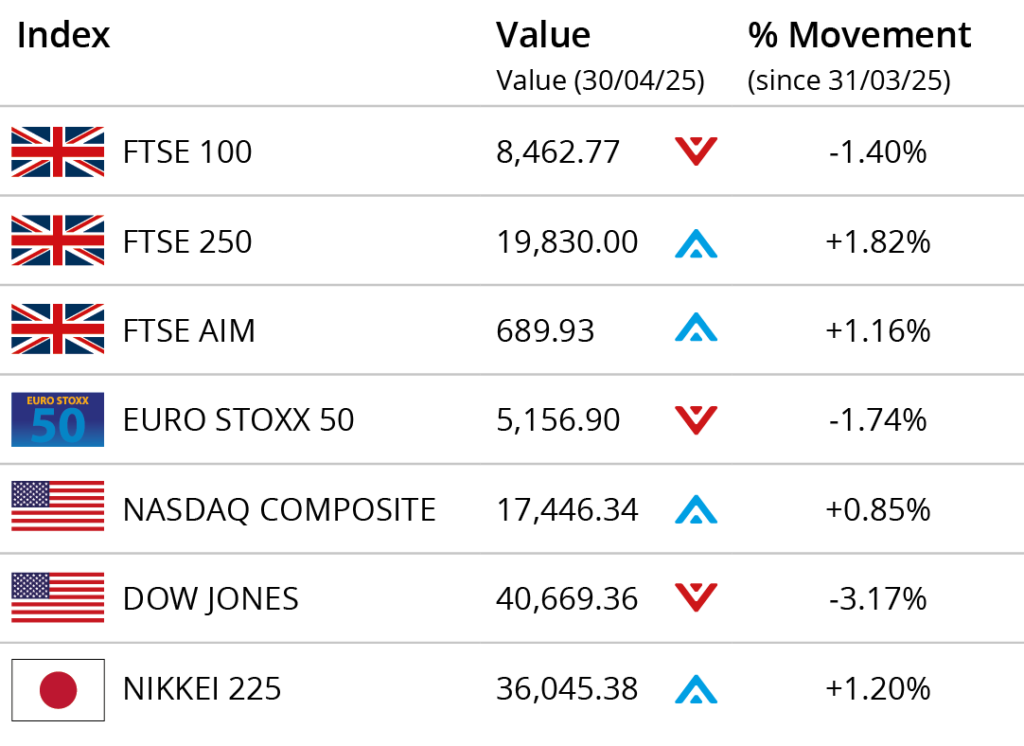

The US economy shrank at an annualised rate of 0.3%, as government spending fell and imports surged, with firms racing to get goods into the country ahead of tariffs. The contraction follows robust growth of 2.4% recorded in Q4 2024. The Dow Jones closed the month down 3.17% on 40,669.36, while the tech-orientated NASDAQ closed April up 0.85% on 17,446.34.

On the continent, the Euro Stoxx 50 closed the month 1.74% lower on 5,156.90. In Japan, the Nikkei 225 ended April on 36,045.38, a monthly gain of 1.20%. In the UK, the blue-chip FTSE 100 index closed April on 8,462.77, a loss of 1.40%. The mid-cap focused FTSE 250 closed the month up 1.82% on 19,830.00, while the FTSE AIM closed on 689.93, a gain of 1.16%.

On the foreign exchanges, the euro closed the month at €1.17 against sterling. The US dollar closed at $1.33 against sterling and at $1.13 against the euro.

Gold closed April trading around $3,317 a troy ounce, a monthly gain of over 5%. The price has pulled back from recent all-time highs as geopolitical tensions eased slightly as a result of Trump’s tariff relief orders. Brent Crude closed the month trading at around $61 a barrel, a monthly loss of over 18.00%. The oil price fell at month end as demand concerns weighed.

Retail sales see strong quarterly rise

Official retail sales statistics published last month revealed that sales volumes grew at their fastest rate in nearly four years across the first three months of 2025.

According to the latest monthly ONS figures, retail sales volumes rose by 0.4% in March, defying economists’ expectations of a 0.4% decline. ONS said sales at garden centres were boosted by March’s sunny weather, while demand for clothing and DIY goods also proved to be strong. This left sales across the first quarter as a whole up by 1.6%, the largest three-month growth rate since July 2021.

Data from GfK’s most recent consumer confidence survey, however, suggests sales may not grow so quickly over the coming months. In April, the closely watched gauge of British consumer sentiment fell to its lowest level since late 2023, with GfK saying rising household bills and turbulent global financial markets were behind the drop in confidence.

The latest CBI Distributive Trades Survey found that retailers are also relatively pessimistic about the future outlook. Although the survey’s monthly sales gauge for April was actually higher than the comparable figure for March, respondents said they expect the retail environment to worsen this month reflecting concerns about weak consumer sentiment and global economic uncertainty.

Jobs market continues to weaken

The latest set of UK labour market statistics showed that demand for workers continued to wane in the run-up to April’s National Insurance and minimum wage changes, although pay growth once again remained strong.

Figures published last month by ONS revealed another decline in the overall number of job vacancies. In total, there were 26,000 fewer vacancies reported between January and March 2025, leaving the estimated number of jobs on offer at 781,000. This leaves vacancies 15,000 lower than in the same period in 2020, marking the first time since March to May 2021 that the total has fallen below its pre-pandemic level.

Survey evidence also points to a further softening in demand for labour. Data from April’s S&P Global/CIPS PMI, for example, found job cutting remains ‘aggressive’ across the UK private sector as firms grapple with the twin pressures of decreased workloads and rising payroll costs; survey respondents widely noted that squeezed margins had resulted in the non-replacement of voluntary leavers.

The ONS data, however, did show that wage growth remains strong. Indeed, average weekly earnings excluding bonuses rose at an annual rate of 5.9% in the three months to February, up from 5.8% in the previous three-month period.

All details are correct at the time of writing (01 May 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.